If you're curious about investing in Yearn vaults, so was I. Here's some things I found out.

Think about contract risk

No investment is without risk, and Yearn is no different. One thing worth keeping in mind is that Yearn acts as a wrapper for other protocols. So you're taking on a little bit of smart contract risk for everything your chosen vault touches.

For example, I use a number of vaults that rely on Curve.fi pools.

If we take the crvALUSD vault as an example, this means that I'm taking on a number of risks:

- The risk of failure in vault contract itself

- The risk of failure in Curve pool contract

- The risk that alUSD loses its peg

The trouble with assessing contract risk is that I don't know a lot of ways to quantify it. I think for the most part, what most of us playing in this ecosystem use as a rule of thumb is time and capital concentration. If a project has existed for a reasonable length of time with a lot of capital at stake with no incidents, that's about as good of an indication of robustness as we get most of the time.

In the case of this vault, I would assess that list of risks this way:

- There's lots of Yearn vaults, and they all use a similar interface, they get reviewed a bit before they're posted on Yearn, and there hasn't been a big incident with any vaults since v2. So relatively low risk here.

- Same with Curve, there are lots of pools, so the interface gets used a lot and there's no incidents with Curve pools that I'm aware of. Relatively low risk.

- Alchemix.fi is a relatively new protocol, and the value of the stablecoin alUSD relies on some novel mechanisms which could put the coin at risk of losing peg should the yield backing their loans dry up, dramatically reducing demand for their product and the liquidity enabling alUSD to hold its peg. That said, I don't really have a way of calculating the likelihood of an event like that.

This is just a thought process for being aware of what risks are being taken on, and I do this for most DeFi products I invest in. Admittedly, though, putting numbers to these risks in actuarial fashion is a tough/insoluble problem for me. Anyone that has a framework for thinking about that, I'd love to read about it (@ me on Twitter).

You Don't Usually Need the Underlying Asset to Invest

Most of the v2 vaults use Zapper under the hood to convert whatever assets you have in your wallet into the asset you need to invest in the vault.

This is especially useful if you're newer and don't yet know HOW to get the underlying coin the vault requires. For instance, I didn't know the series of operations necessary to get Curve pool tokens, or how to get sUSD.

Also, if you have to do all the operations to get a target asset one at a time, the gas costs can get pretty crazy, almost defeating the point of investing in the vault for a month or two depending on how much you're investing.

So the convenience of having Zapper available to convert whatever you have to what you need both in and out of the vault is nice.

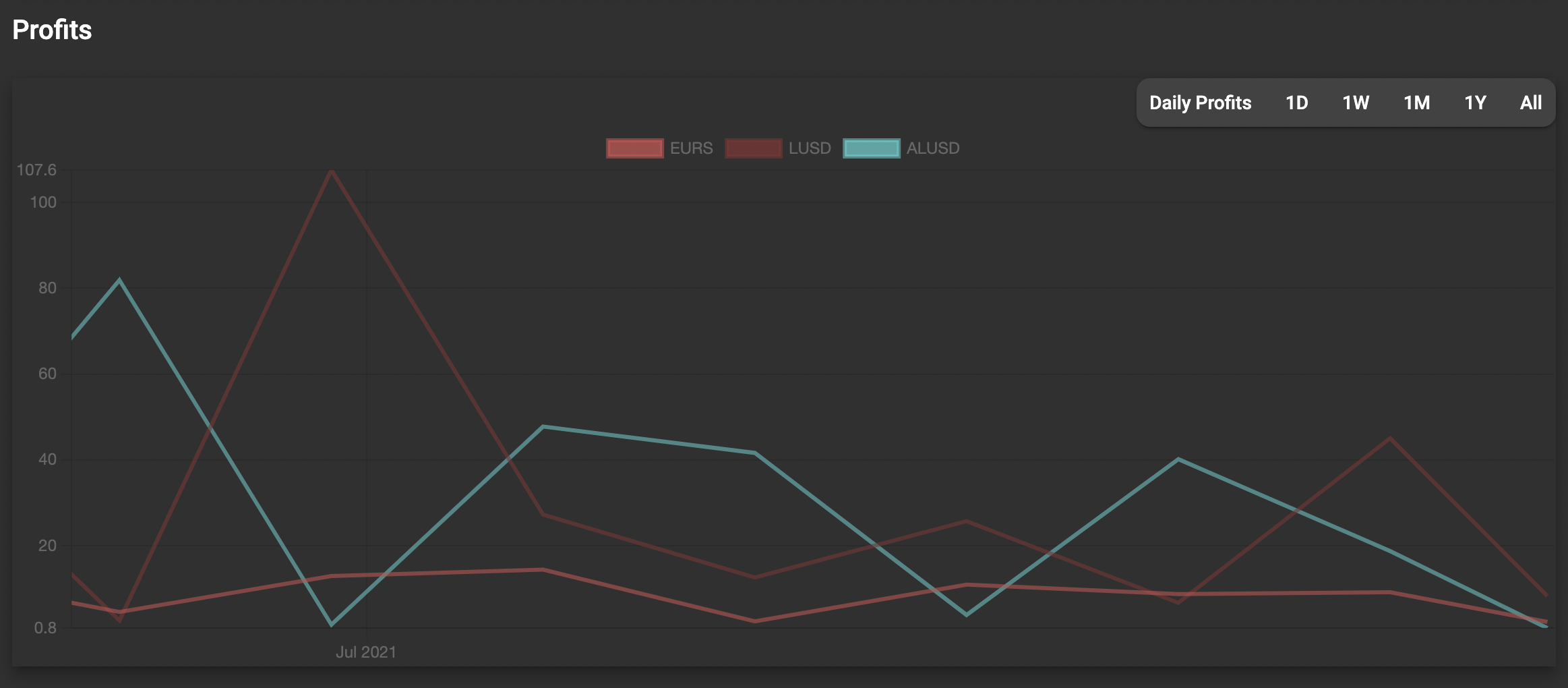

Use Trackavault.com

Assuming you've picked a vault and are willing to accept the risk of a smart contract black swan event, one of the next things you'll want to do is see how your vault is performing over time.

I'm not sure how the APY's listed on the Yearn vaults are calculated exactly, but I do know they change a little bit daily based on market conditions. So it's nice to have something that shows you the day to day earnings of your vault.

Conclusion

DeFi in general is a frontier with new problems being solved every day. When you get involved you're taking on risk, so it's not a fit for everyone just yet.

But for the bold, the excitement can be enough to balance the risk with the opportunity to live in the future of financial products and watch the evolution happen.